Environmental, social and governance (ESG) issues have risen to the top of the agenda for financial institutions as the global sustainability movement gains momentum.

As stakeholders increasingly pore over banks’ green credentials, it has become even more urgent for financial institutions to weave ESG considerations into every aspect of their business.

ESG and traditional banking risks are intertwined

As gatekeepers to capital, banks play a crucial role in helping nations and companies meet ambitious net-zero targets. But the road to carbon neutrality is also riddled with risks, specifically those of an ESG nature.

ESG risk is the potential negative financial impact that can arise from the effect ESG issues have on a bank and its stakeholders.

As it is, ESG risks intersect heavily with traditional banking risks such as credit, market and operational risks. For instance, a climate change event such as a flood can affect the financial viability or credit quality of borrowers. This can have financial consequences for banks.

Transparency: a business imperative

In todays’ era of transparency, it is imperative that banks take proactive steps to manage and disclose sustainability risks. ESG risk reporting therefore offers an opportunity for banks to be more forthcoming about how ESG factors can affect their performance and market position.

Banks that understand this can control the narrative on how their sustainability efforts are perceived in the eyes of stakeholders.

Europe leads on ESG disclosure

The regulatory regime for ESG disclosure is still evolving, but it’s clear Europe has made greater progress in this area. The European Banking Authority (EBA) has published standards on ESG risk reporting including details on how climate change can affect balance sheet risks and how financial institutions can mitigate those risks.

Separately, the European Central Bank has issued guidance on risk management and disclosure on climate-related risks. There’s also the EU Taxonomy Regulation which defines “environmentally sustainable” economic activities and suggests how banks should report the financing of these activities.

Progress uneven in Asia

In Asia, financial rivals Singapore and Hong Kong have already championed greater transparency on ESG reporting. The Monetary Authority of Singapore has published guidelines on environmental risk management for financial institutions while the Hong Kong Monetary Authority has issued a framework to promote ESG initiatives in the financial services sector.

Yet, on the whole, Asia’s financial sector lags behind Europe in adopting ESG reporting and risk management processes.

Harmonising policies with TCFD recommendations

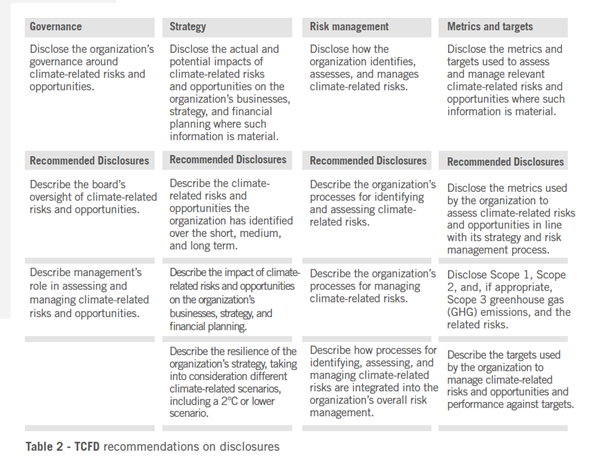

To align with international standards, Asia’s banks can consider adopting the recommendations of the industry-led Task Force for Climate-Related Financial Disclosures (TCFD). Created by the Basel-based Financial Stability Board, the TCFD framework focuses on four thematic areas – governance, strategy, risk management, and metrics and targets.

Widely considered as best practice, the TCFD framework offers a standardised approach towards disclosing information on the financial implications of climate-related risks and opportunities.

As TCFD recommendations address ESG issues at both the strategic and operational level, they offer a holistic view on how banks are managing ESG-related risks.

To successfully navigate the sustainability journey, banks need to embed ESG factors into their risk management processes. While they may initially face roadblocks such as data collection issues, Asia’s financial institutions need to demonstrate that they take climate change reporting seriously. The TCDF recommendations are a good place to start.